Biden’s Plan for Debt Forgiveness Explained

Biden announces a three pronged plan for addressing soaring student loan debt which many Americans say is keeping them from long term investments in housing and retirement

November 27, 2022

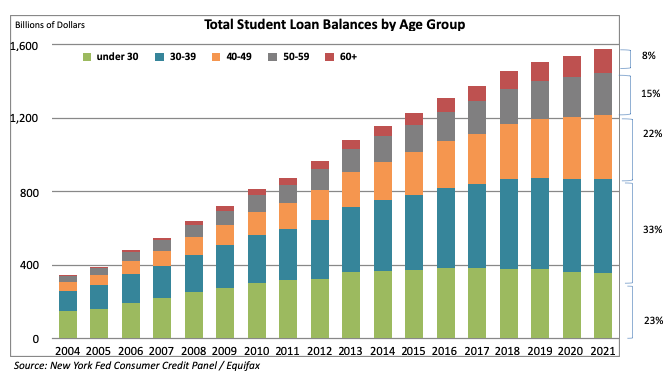

President Biden’s debt forgiveness plan sought to give financial relief to students who have taken loans for their education–past, present, and future–in light of the pandemic, as well as increasingly high tuition costs for higher education.

“All of this means people can start to finally to climb out from under that mountain of debt … to finally think about buying a home or starting a family or starting a business. And by the way, when this happens, the whole economy is better off.”

There are three parts to his plan: the first is student debt cancellation of up to $10,000 or up to $20,000 for Pell Grant recipients. The debt cancellation seeks to address those in most need by capping qualifying incomes at $125,000 or $250,000 for married couples. This way, an estimated 87% of the relief will go towards those making less than $75,000 a year.

Biden’s relief plan will affect the vast majority of borrowers by reducing the debt of 43 million borrowers and even canceling debt completely for 20 million borrowers. Those who wish to apply for relief would do so by filling out an application that the government has yet to release. It is possible that debt forgiveness could revive old dreams of pursuing higher education without the worry of loans and financial problems, especially with the pressure of higher education becoming more and more important in securing a high-paying job.

The second part of the plan caps monthly repayments at 5% instead of 10% of a borrower’s discretionary income (one’s remaining income after paying for necessities like food and rent), on top of raising the standard for what is considered to be discretionary income. It also plans to forgive balances after ten years of repayments instead of twenty years of repayments.

Lastly, there is a focus on increasing accountability for schools that do inflate their prices through establishing an enforcement unit to hold accreditors of schools with severe cases of for-profit and creating an annual list for the programs with most debt.

President Biden had also stated that the student loan pause, which has been effective since December 11, 2020 through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, is extended until the end of this year.

Biden’s relief plan was put to a halt when six Republican states sued under the premise of harming their tax revenue and for the lack of authority to carry out this plan as it was bypassing Congress. The lawsuit was thrown out twice due to the lack of legal standing or proof that they are being harmed by this policy, until the legal proceedings were temporarily stopped by an appeal court judge.

On Thursday, November 10, a Texas court ruled the plan unconstitutional after two borrowers sued the government because the plan only took income into account. The judge argued that the HEROES act used to bypass Congress was not applicable, thereby denying debt cancellation for all applicants.

The plan overall would also have been demanding in terms of funding, as it was expected to cost more than $400 billion.

While the concept of student loan forgiveness is popular, Biden’s plan prompted fierce political debates. One of the opposing arguments had (incorrectly) claimed that students with debt from school expenses usually have degrees and high-paying jobs. The cap on qualifying incomes attempted to eliminate this issue; in addition, almost one-third of borrowers have debt without a degree, as the crushing debt prevents many from continuing their education.

The plan overall would also have been demanding in terms of funding, as it was expected to cost more than $400 billion. Despite economists’ worries of greater inflation, the average cost of college has actually risen faster than inflation, and progressive Democrats in Congress insisted that this plan was critical to fix racial economic disparities and raise the living standards for millions of people across the country.

Some Americans demonstrated their optimism towards Biden’s plan, expressing that they might actually return to school if his plan works in reducing their financial worries. However, many Americans were skeptical at its proposed effectiveness.

A major issue was that Biden’s plan focused singularly on the current income of borrowers, instead of their wealth as a whole: many Americans who apply for government loans do so because of a lack of familial wealth. The crisis of student debt exacerbates the issue of stagnant generational wealth amongst minority communities, and former students are unable to advance financially despite their education because of the looming threat of their debts.

Dealing with immense debt is affecting Americans in many ways, including influencing what sort of jobs they are looking for in order to pay off that debt. “I used to work in jobs where I did not make six figures, but they were jobs that fed who I am as a person and how I want to contribute to society,” says Georgetown University graduate Bre Jefferson. “I have to decide now if I want to go after financial success or work in a job that aligns with my intrinsic values.”

In addition, student debt has prevented Americans from planning for long-term investments, such as down payments for houses or plans for retirement, which further hinders their abilities to grow essential generational wealth.