If you spent $1 every second starting from when the first coins were recorded, you would have already spent an insane $82 billion by now. But today, money has evolved dramatically, moving from metal coins to digital currencies. Now, we stand at the edge of a financial revolution, where every transaction could be as secure as a digital fingerprint: blockchain technology.

First, let’s go through a brief history of money throughout human civilization. The barter system was the first form of trade, involving direct exchanges of goods and services (e.g., a farmer trading a bushel of wheat for a pair of shoes). Early “currencies” included valuable items at the time like seashells, silk, and grains, but these were impractical to store and transport (grains and salt could spoil, seashells and silk were delicate).

Metal coins—gold, silver, copper—eventually replaced them due to their durability and ease of transport. Over the centuries, however, carrying large quantities of coins also became inconvenient. Thus, traders began using receipts representing multiple coins, with a trusted third party later redeeming them. These receipts gradually evolved into the paper money we use today.

Currently, society revolves around a centralized banking system in which all transactions must be done through a central bank such as the Bank of America, Bank of India, etc. This system has its positives and its pitfalls: small transactions like $50 can be executed very quickly through ATMs, but larger transactions of thousands of dollars or international transactions can take multiple days or weeks.

This can devastate families in war-torn or poverty stricken areas who don’t have days or weeks to survive, but mere minutes. Even when an individual is willing to wait and decides to send money, the sender faces excessively high transaction processing fees—an additional fee that helps banks make money. This obstacle, coupled with frustrating wait times, makes our current centralized banking system unnecessarily inconvenient.

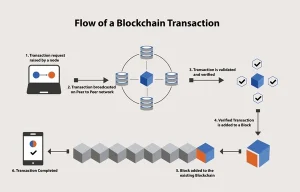

Here is where blockchain technology can be revolutionary. Blockchain is a chain of digital “blocks,” where each block holds a list of transactions—usually the central bank has this list, but now it is visible on a block in the blockchain. When new information is added, it gets grouped into a block and linked to the chain.

A unique feature of blockchain is that it is entirely open-source and transparent, meaning anyone can see the list of transactions. Once it’s there, an external source cannot alter it without a specific code known as a private key that cannot be guessed even with powerful supercomputers – an example private key is: 8a806914ccd0030a5e6776fa1ad51f3c2bf4eb9f0da44346ff4971075629ada8.

This system is called a decentralized ledger because the data isn’t stored in one single place. Instead, it is copied across many computers, called nodes, all over the world. Each node has its own copy of the entire blockchain, and they work together to verify new transactions added to blocks.

Blockchain’s decentralized nature highlights its promising potential to solve many of the centralized system’s problems. For instance, transactions no longer have to be processed by slow central banks and could happen nearly instantaneously with blockchains—companies like Aptos are already processing tens of thousands of transactions per second.

Furthermore, senders do not face high processing costs because there is no bank with an incentive to make money. Besides increasing speed and reducing costs, blockchain technology has several other promising solutions: solving corruption by eliminating middlemen and enhancing security by making transactions publicly visible, just to name a few.

Money makes the world go round, but it is also making it slow down. The current centralized banking system presents multiple obstacles such as slow transaction times and excessive processing costs, but blockchain technology has the ability to transform this system for the better.

Blockchain technology, however, does have scalability issues because it has not been widely tested at an international level, and many are uncomfortable with this fundamental upheaval of basic transactions. From bartering and livestock trade to blockchain and ledger technology, society has come a long way. As blockchain continues to reshape our world, we all have the power to embrace innovation and shape a future built on security and transparency.