For the majority of students in the United States, college is a luxury beyond reach, due to the financial burden it presents. To alleviate this hardship, the Department of Education allows college and university students to submit a Free Application for Federal Student Aid, or FAFSA, each year. Based on the FAFSA, the Department of Education provides approximately $112 billion in grants, work-study, and loan funds to over 10 million students annually.

In 2020, Congress passed the FAFSA Simplification Act, which shortened the application significantly—from 106 to 36 questions—with the intent of incentivizing students to apply and pursue higher education. Surveys have shown that students who submit a FAFSA are 84% more likely to attend college, but the complex nature of the form prior to recent changes had posed a significant challenge to many. Because of this streamlining process, an estimated 220,000 more students will apply for FAFSA loans, meaning more will have the opportunity to benefit from higher education without the pressure of finances.

The Department of Education has also made changes to the eligibility requirements for financial aid. The minimum income eligibility for the Pell Grant, a need-based subsidy provided by the government, has been raised. According to the Department of Education, 610,000 more students will be eligible for a Pell Grant, and 1.5 million more students will qualify for the maximum amount.

This act has also lifted prohibitions on FAFSA submission for students with drug or felony convictions, and for those not registered with selective service. In addition, incarcerated students will now be eligible for the Pell Grant.

However, not all students will benefit from changes to the FAFSA. The new formula for calculating aid removes the “sibling discount,” which once made families with more than one student in college eligible for more aid.

Additionally, in previous years, the FAFSA did not require income from small businesses or family farms to be reported as assets. The FAFSA Simplification Act has removed this exclusion, meaning these families will be expected to contribute more than previous years to their student’s tuition.

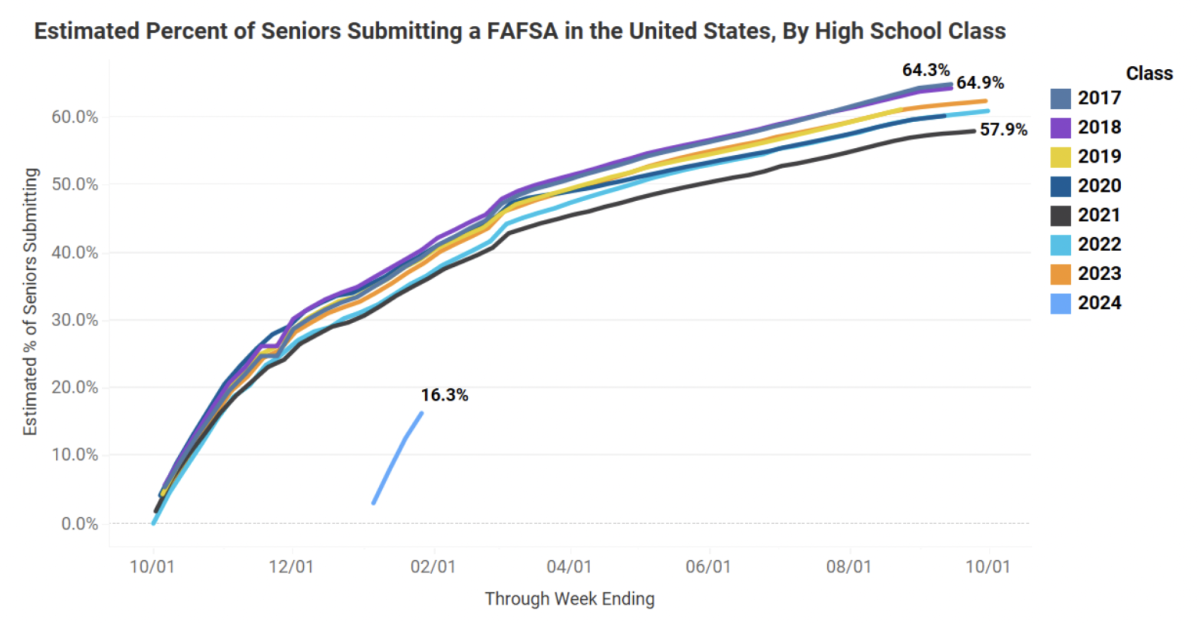

Typically, the FAFSA opens in October. However, the new FAFSA was not made available until January of 2024, over three years after the FAFSA Simplification Act was passed. Since its release, several issues have been found including glitches, limited availability, and most notably, its failure to account for inflation. This last component of the equation would cost students $1.8 billion, and though the Department of Education has said they will solve the issue, they have not yet announced how or when.

Recently, the Department of Education stated that schools will not begin to receive students’ financial information until March, delaying aid offers until April. All in all, this indicates possible further delays and issues in the future of the system.

For the next graduating class of seniors, these changes could have lasting effects on the financial aid system, especially since over 70% of families apply for a FAFSA already. Widened Pell Grant brackets will only increase this number, but the Department of Education is ultimately tasked with the challenge of meeting heightening customer demands and adhering to time constraints. With a fully functioning system, the new FAFSA could have the potential to help more, faster, better.